Glass Weekly: The overall market stabilized and the tone remained unchanged. The regional flexibility was slightly increased (20250424 issue)

01 Industry News of the Week

《How do photovoltaic companies transform and upgrade? This "roundtable meeting" said so》

Recently, the 11th roundtable meeting of the China Photovoltaic Solar Energy High-Efficiency Heterojunction 760W+ Club was successfully held in Chengdu, Sichuan Province. Liansheng Photovoltaic Technology Co., Ltd. served as the rotating chairman of this meeting, which brought together representatives of 14 leading companies in the heterojunction field such as Jiangsu Guangshi Energy and Tongwei Group and some industry institutions to jointly discuss the breakthroughs in photovoltaic heterojunction technology and the path of industrial upgrading, and to draw up a new blueprint for the transformation of clean energy.

It is reported that this meeting focused on the frontier breakthroughs of heterojunction technology, innovative application scenarios and benchmark cases, and was committed to building an industrial chain collaborative innovation platform to promote upstream and downstream companies to share green development opportunities.

The meeting also conducted in-depth discussions on core issues such as heterojunction battery efficiency improvement, cost reduction path, equipment localization, and multi-scenario application. Experts at the meeting shared the latest technological achievements, including the research and development progress of 760W+ high-power modules, the exploration of the integration of heterojunction and perovskite stacking technology, and practical cases of innovative application scenarios such as BIPV (photovoltaic building integration) and offshore photovoltaics. The meeting pointed out that collaborative innovation in the upstream and downstream of the industrial chain is the key to breaking through technical bottlenecks and reducing manufacturing costs. It is necessary to further strengthen in-depth cooperation in materials, equipment, processes and other links to build an efficient and open heterojunction industry ecosystem.

Through roundtable dialogues, special reports and other forms, this meeting has promoted a number of technical cooperation intentions, and proposed the establishment of a heterojunction technology collaborative innovation alliance to accelerate the transition from laboratory to industrialization. The participating companies unanimously stated that they will work together to overcome the difficulties in large-scale production of heterojunctions, promote the continuous decline in photovoltaic electricity costs, and help achieve the "dual carbon" goals.

《SORG Group built the world's largest regenerative horseshoe flame glass melting furnace for FEVISA》

The German SORG Group built the world's largest regenerative horseshoe flame glass melting furnace for FEVISA Group (an internationally renowned glass packaging company) at its factory in San Luis Potosí, Mexico.

The melting area of the furnace is about 190 square meters, and it is designed mainly for the production of glass bottles and glass containers with soda-lime glass components, including colored flint glass and Georgian green glass. SORG’s design integrates electric boosting in the melting zone, the furnace sill zone and the flow tunnel into a gas-fired glass melting furnace. The glass conditioning system at the working end of the furnace consists of a SORG STW distributor and three SORG 340S+® branch feeders. The batch material is fed via two IRD® feed tanks, each equipped with an EME-NEND® S3 feeder.

SORG developed the structural design of the furnace, distributor and feeder for this project, as well as the engineering design of the related ancillary equipment.

This complete glass melting system includes the natural gas combustion system, emergency electric heating system, cooling water system and furnace ancillary equipment supplied by SORG. The furnace, distributor and feeder are controlled by the SORG SCADA WINCC redundant software control system.

The conditioning systems for the furnace and the working end were installed under the supervision of SKS.

In addition, in June 2024, HORN® GLASS INDUSTRIES of Germany built a 560TPD horseshoe flame glass melting furnace for glass manufacturer Bastürk Cam in Malatya, Turkey. The melting area of the furnace is 185.4 square meters. It is also a hybrid melting furnace integrating natural gas combustion system and electric melting system. Its working end is equipped with 6 feeding channels for the production of bottle glass.

02 Float glass market analysis

2.1. Float glass market analysis

This week, the domestic 5mm float glass market maintained a stable pattern as a whole. This week, the overall transaction atmosphere in the North China market was light. The price of large plate glass in Shahe area was under pressure and downward. Some manufacturers slightly reduced their quotations by 20-30 yuan/ton. Due to the relative balance of supply and demand for small plate glass, some manufacturers tentatively raised the price by 10-20 yuan/ton. The inventory of manufacturers in Shahe area showed a slight growth trend. The market performance in the southwestern Yunnan and Guizhou regions has rebounded significantly this week, mainly benefiting from the positive impact of the capacity contraction in Yunnan. The maintenance of some production lines has led to a contraction in the supply side, and the circulation of goods in surrounding areas has accelerated significantly. The overall operation of the East China market is stable, and most production enterprises maintain a stable production and sales rate of 80-90%. Some large enterprises maintain good shipments through flexible sales strategies. Other regions continue to focus on stable prices for shipments, and the overall shipment situation is general. The downstream generally maintains a cautious attitude, and most orders show the characteristics of "small orders and short orders". Overall, the float glass market this week still shows a weak balance between supply and demand. From the demand side, terminal rigid demand purchases remain stable, but the increase is limited; in terms of supply, the industry's capacity is expected to remain stable in the short term, and there is no large-scale cold repair or resumption of production plan; in terms of price strategy, most companies choose to wait and see at a stable price. It is expected that the overall market will still maintain a stable operating tone.

In terms of futures, the price of glass futures during the week was mainly fluctuating at a low level. The overall atmosphere of the current glass market is low, mainly because the logic of the fundamentals is weak and funds have significantly suppressed the profits on the market. However, as the futures price fell to the discount of Hubei spot, it temporarily lacked further downward pressure. With the rapid decline in the previous market, the midstream shipments were relatively smooth, which released a certain amount of inventory replenishment space in the midstream. Although the short-term glass futures price is still weak, we can pay attention to whether the policy can give a repair expectation and thus give a premium space to stimulate speculative demand.

2.2. Comparison of float glass market prices

03 Statistics of float glass production profits this week

3.1. Profits of float glass production

As of April 24 this week, the average weekly profit of float glass fueled by petroleum coke was -38.35 yuan/ton, a decrease of 34.29 yuan/ton from the previous month; the average weekly profit of float glass fueled by natural gas was -153.13 yuan/ton, an increase of 13.72 yuan/ton from the previous month; the average weekly profit of float glass fueled by coal-to-gas was 145.05 yuan/ton, an increase of 16.36 yuan/ton from the previous month. Glass profits rebounded slightly during the week, and profits were steadily restored.

3.2. Profit trend of float glass production

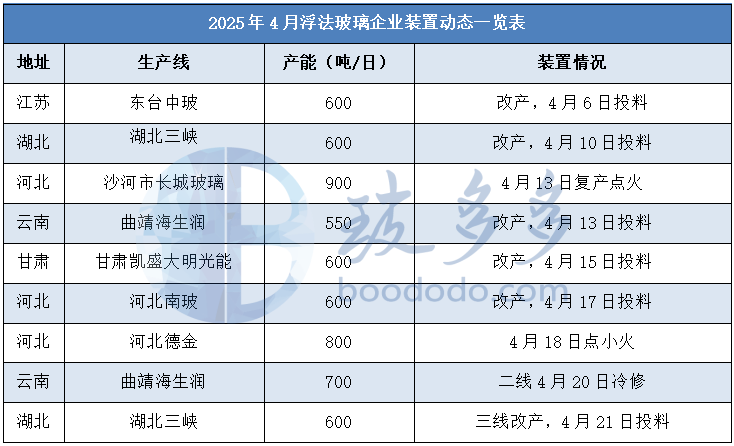

04 This week, the maintenance and production changes of float glass enterprises

4.1. The dynamics of float glass enterprises and the start-up situation

This week, the weekly operation rate of float glass is 75.85%, an increase of 0.19% month-on-month. Some units resumed production and ignited this week, and the industry's start-up rebounded slightly.

4.2. Weekly output of float glass enterprises

This week, after eliminating the zombie production lines, there were a total of 297 domestic glass production lines, of which 224 were in production, and the output of float glass was 1.1058 million tons, a decrease of 0.29% month-on-month, and the output fell slightly during the week.

05 Statistics of float glass inventory this week

This week, the total inventory of float glass manufacturers is 65.4733 million TEUs, and last week was 65.078 million TEUs, a month-on-month increase of 39.53 TEUs, an increase of 0.65%; the shipment situation in various regions of the country is different, and the shipment in some regions is average, and the inventory has increased slightly. At present, the inventory of most companies is at a high level, mainly around shipment, but there are differences in production and sales among companies. Some shipments are acceptable, and most performance is average.

06 Analysis of upstream and downstream industries of float glass

6.1. Analysis of soda ash market this week

This week, the domestic soda ash market maintained a weak consolidation, and local prices fell slightly. As of Thursday this week, the price of light soda ash was 1050-1620 yuan/ton, and the price of heavy soda ash was 1050-1600 yuan/ton. On the supply side, the overall operating rate of the soda ash industry remained high this week. The soda ash unit of Tianjin Soda Plant was under maintenance, and the current operating rate dropped to about 50%. The shutdown and maintenance of Southern Soda Industry is expected to last for 3 days. Inner Mongolia Boyuan Yingen Chemical has basically recovered. The operation of other enterprises is temporarily stable. Inventories are still at a medium-high level this week. On the demand side, affected by the release of new production capacity and the sluggish willingness of downstream purchases, the inventory of enterprises continued to accumulate. Some manufacturers eased the pressure of shipments by making small concessions. The overall trading atmosphere in the market was light, and wait-and-see sentiment dominated. In the short term, the soda ash market lacks a clear upward drive, prices hover in the bottom area, and the overall trend is weak. The maintenance expectations in May increased, and it is necessary to pay close attention to the implementation of the industry maintenance plan and changes in the downstream demand side.

6.2. Real estate industry data statistics

In January-March 2025, the housing construction area of real estate development enterprises was 613.705 million square meters, a year-on-year decrease of 9.5%. Among them, the residential construction area was 427.237 million square meters, a decrease of 9.9%. The newly started housing area was 129.96 million square meters, down 24.4%. Among them, the newly started residential area was 94.92 million square meters, down 23.9%. The completed housing area was 130.60 million square meters, down 14.3%. Among them, the completed residential area was 95.02 million square meters, down 14.7%. From January to March, the sales area of new commercial housing was 218.69 million square meters, down 3.0% year-on-year, and the decline narrowed by 2.1 percentage points compared with January to February; among them, the residential sales area fell by 2.0%. The sales of new commercial housing was 2079.8 billion yuan, down 2.1%, and the decline narrowed by 0.5 percentage points; among them, the residential sales fell by 0.4%.

In the first quarter, the situation of my country's real estate market improved significantly, and the policy effect of promoting the stabilization of real estate continued to show. Data show that the sales area of commercial housing in March increased month-on-month driven by the recovery of the core cities, and the number of cities with month-on-month increases in new and second-hand housing prices increased, and the recovery in sales led to marginal improvement in the cash flow of real estate companies.

Source | Boduoduo Data Group

Copyright Statement: This article is produced by Boduoduo Data Group. If you need to reprint, please contact the staff for authorization (please indicate the source if you reprint after authorization)

- Soda Ash Weekly: Supply and demand pattern has not improved and the market continues to decline (20250424 issue)1031

- Glass Weekly: The overall market stabilized and the tone remained unchanged. The regional flexibility was slightly increased (20250424 issue)1222

- 4.23 Soda Ash Daily Review: Soda Ash Market Consolidated, Manufacturers Strongly Determined to Stabilize Prices1028

- 4.23 Glass Daily Review: Float glass market overall stable, with slight increases in some areas1028

- 4.22 Soda Ash Daily Review: Soda Ash Market Consolidated in Weakness, Local Prices Slightly Declined1076