Soda Ash Weekly: The imbalance between market supply and demand has intensified, and prices continue to fall (20250403 issue)

01 Industry News This Week

《Fulite's net profit in 2024 exceeds 1 billion yuan, and the construction of photovoltaic glass projects will continue to be promoted》

Fulite released its 2024 annual performance report on March 28. During the reporting period, the company achieved a total operating income of 18.683 billion yuan, a year-on-year decrease of 13.20%; a net profit of 1.007 billion yuan, a year-on-year decrease of 63.52%; basic earnings per share was 0.43 yuan.

Fulite's main businesses involve four major areas: photovoltaic glass, float glass, engineering glass, and home glass, as well as the mining and sales of quartz ore for glass, the construction of solar photovoltaic power stations, and electricity sales. Among them, the research and development, production and sales of photovoltaic glass are the company's main business.

The announcement shows that Fulai is currently continuing to promote the construction of photovoltaic glass projects in Anhui Base, Nantong Base and overseas Indonesia Base, which still requires a lot of capital investment. After comprehensively considering the current industry situation, the company's actual operating conditions, the demand for self-owned funds for projects under construction and other factors, the company intends not to distribute the profits in 2024, nor to increase capital by capital reserves. The undistributed profits will be used for the company's own capital investment needs for projects under construction, to ensure the company's sustained, stable and healthy development, further improve the company's comprehensive competitiveness, and also benefit long-term returns to investors.

《Total investment of 12.5 billion! Inner Mongolia Tongliao Naiman plans to build a new 1.25 million tons of baking soda and 13 million tons of natural alkali project》

The land use scope of the Naiman Natural Alkali New Materials Industrial Park project in Tongliao, Inner Mongolia involves Yaoledianzi Village, Angnai Village, and Guliu Village in Daqintala Town, Naiman Banner, Tongliao City.

The first construction project in the park is the annual production of 1.25 million tons of baking soda production line construction project of Inner Mongolia Yuanqi Green Energy Construction and Operation Co., Ltd. Construction content: 2 new baking soda production lines, with an annual output of 1.25 million tons of baking soda. Construction of baking soda production workshops, packaging workshops, warehouses and related ancillary facilities. The total investment is 250000.00 million yuan, and the source of funds is self-raised by the enterprise. Planned construction time: March 2025-February 2027.

The second is the first phase of the light soda ash (natural soda) project of Inner Mongolia Yuanqi Green Energy Construction and Operation Co., Ltd. Construction content: Build 2 new soda ash (natural soda) purification production lines, with an annual output of 2 million tons of light soda ash (natural soda). Build soda ash (natural soda) purification workshops, warehouses, packaging workshops and related ancillary facilities. The total investment is 200000.00 million yuan, and the funds come from the company's own funds. Planned construction time: March 2025-February 2027.

The third is the second phase of the light soda ash (natural soda) project of Inner Mongolia Yuanqi Green Energy Construction and Operation Co., Ltd. Construction content: Build 1 new soda ash (natural soda) purification production line, with an annual output of 1 million tons of light soda ash (natural soda). Build soda ash (natural soda) purification workshops, warehouses, packaging workshops and related ancillary facilities. The total investment is 200000.00 million yuan, and the funds come from the company's own funds. Planned construction time: March 2025-February 2027.

Fourth, the heavy soda ash (natural soda) phase I project of Inner Mongolia Yuanqi Green Energy Construction and Operation Co., Ltd. Construction content: 6 new soda ash (natural soda) purification production lines, with an annual output of 6 million tons of heavy soda ash (natural soda). Construction of soda ash (natural soda) purification workshop, packaging workshop, finished product warehouse and related ancillary facilities. The total investment is 300000.00 million yuan, and the funds come from the company's own funds. Planned construction time: March 2025-February 2027.

Fifth, the heavy soda ash (natural soda) phase II project of Inner Mongolia Yuanqi Green Energy Construction and Operation Co., Ltd. Construction content: 4 new soda ash (natural soda) purification production lines, with an annual output of 4 million tons of heavy soda ash (natural soda). Construction of soda ash (natural soda) purification workshop, packaging workshop, finished product warehouse and related ancillary facilities. The total investment is 300000.00 million yuan, and the funds come from the company's own funds. Planned construction time: March 2025 - February 2027.

02 Analysis of the soda ash market

2.1. Analysis of the soda ash market

The domestic soda ash market continued to operate weakly this week, and prices still fell slightly. As of Thursday this week, the mainstream price of light soda ash was 1400-1600 yuan/ton, and the price of heavy soda ash was 1500-1650 yuan/ton. At the beginning of the month, soda ash companies in various regions successively issued new prices, and the prices of new orders mostly declined. The spot market transaction was not good, the transaction center of gravity was stable and downward, and the high price fell more; the previous maintenance companies resumed production, and there were no many maintenance plans in the short-term market. The supply of soda ash market continued to increase, the market supply and demand relationship was unbalanced, and the soda ash market continued to be weak; as the soda ash price continued to fall, the market trading atmosphere was not good, the high inventory of the alkali plant was difficult to reduce, and the support for the spot market was not good. At present, most companies waited and watched, and the downstream maintained low-price replenishment. Overall, the adjustment space of soda ash prices has narrowed, and the market is still weak and consolidating.

In terms of futures, the overall price of soda ash futures during the week is still mainly fluctuating in the bottom range. At present, the fundamentals of soda ash itself have not changed much, and there is no new speculation point in the short term. The trend during the week mainly follows the downstream glass, but its own supply and inventory pressure have a strong suppression on the market, and the rebound strength is relatively limited. The scale of downstream demand is still in a low-level recovery trend, and with the recent upward revision of glass prices, its ability to undertake raw materials has also been repaired. The valuation support for soda ash still exists. The current futures price is basically flat with the spot price, and the price change range is limited. In the future, attention will be paid to whether the sustainability of the terminal demand repair path can further form a positive transmission to the raw materials.

Forecast for the future market:

1. The maintenance enterprises resumed production, the supply increased, and the imbalance between the supply and demand of soda ash intensified;

2. Downstream demand is still weak, and the purchasing sentiment is insufficient; in the future, attention should be paid to the operation of the device and the progress of the recovery of downstream demand;

3. The soda ash market may continue the weak consolidation trend, and the price is still under narrow downward pressure.

2.2. Comparison of soda ash market prices

03 Statistics of soda ash process profit this week

3.1. Soda ash process profit situation

As of April 3 this week, the profit of the soda ash process was 184.00 yuan/ton, down 27.5 yuan/ton from last week; the profit of the ammonia soda process was -101.00 yuan/ton, down 48.8 yuan/ton from last week. The cost-end price was slightly adjusted downward during the week, the soda ash price fell, and the company's profit fell again.

3.2. Soda ash production profit trend

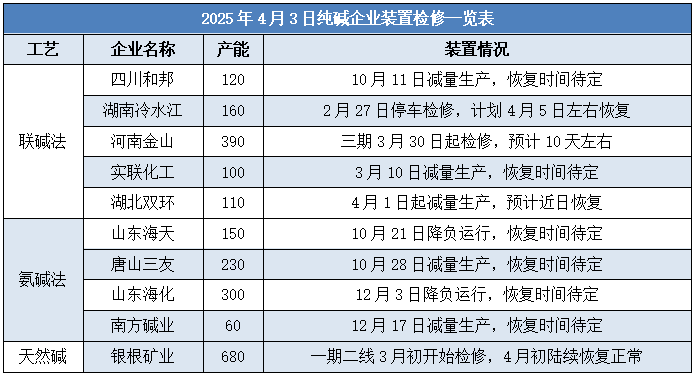

04 This week's soda ash enterprise equipment maintenance and start-up situation

4.1. List of soda ash enterprise equipment situation

4.2. Statistics of soda ash enterprise operation rate during the week

The soda ash industry started about 85.00% this week, an increase of 3.22% from last week. According to incomplete statistics, the output of soda ash manufacturers this week was about 710,000 tons, an increase of 2.85% from last week.

05 Statistics of soda ash inventory this week

This week, the total inventory of domestic soda ash manufacturers was 1.7 million tons, and about 1.63 million tons last week, an increase of 70,000 tons from the previous month, a rate of 4.29%.

06 Analysis of upstream and downstream products of soda ash

6.1. Comparison of spot prices of raw salt this week

This week, the domestic raw salt market was weak and consolidated. As of Thursday this week, the mainstream ex-factory price of domestic sea salt remained at 260-390 yuan/ton, the mainstream ex-factory price of well salt was 250-340 yuan/ton, and the mainstream ex-factory price of lake salt was 210-230 yuan/ton. The focus of the raw salt market is still slightly downward this week. The domestic sea salt inventory in East China has been consumed one after another. The market has entered the late spring season of sea salt ahead of schedule, and the supply has gradually increased. However, there is still inventory of sea salt to be digested in other areas of the region. The market operation level has not changed much, and the inventory has accumulated. Some mineral salt enterprises have maintenance plans in the later period; the operation of some mineral salt enterprises in the southwest region has declined, and the enterprises have destocked, and the price may rebound; the supply of lake salt in the northwest region remains stable, and the price does not change much; the two alkali markets on the demand side are still relatively general, and chlor-alkali enterprises have suppressed the price of raw materials. The price of raw salt may still decline in a narrow range in the later period.

6.2. Analysis of the float glass market this week

The domestic 5mm float glass market as a whole maintained a range of fluctuations this week. At the beginning of the week, the overall operation trend of the domestic 5mm float glass market was stable and weak compared with last Friday. The price of float glass in the North China market was reduced by 10 yuan/ton, the pace of traders' procurement slowed down, the production and sales in Shahe area declined, and the market price generally fell. In the middle of the week, the domestic 5mm float glass market trend turned strong. Among them, under the influence of market sentiment, the price of float glass in the North China market increased by 10 yuan/ton, the shipments of manufacturers in Shahe area improved, the market prices of some specifications rose slightly, and the overall trading was general. The shipments in the Central China market were good, and a small number of companies raised the price by 1 yuan/heavy box, and most prices remained stable. As the weekend approached, the market maintained consolidation. Among them, the shipments of factories in Shahe area were good, and the market prices of some specifications rose slightly under the boost of sentiment, and the overall market transaction was general. The price in the Central China market was temporarily stable today, and the overall shipments were good. Overall, the float glass market this week is still in a state of supply and demand game. Some production lines are planned to be repaired. At present, there is little change in the supply and demand side. Most companies will ship to warehouse, and some manufacturers will make flexible adjustments according to regional demand conditions; the demand side performance is differentiated, and some overall transactions are better than the previous period. Downstream purchases are mainly based on rigid demand, and most have no intention to stock up, and the sales in various regions are different. With the cold repair of some production lines and the potential recovery of the real estate market, the market still needs to pay attention to whether downstream demand can continue to improve in the short term. It is expected that the float glass market may fluctuate in a narrow range.

- 4.15 Soda Ash Daily Review: Individual prices in the soda ash market fluctuated within a narrow range1037

- 4.15 Glass Daily Review: Float glass market is going sideways951

- 4.14 Soda Ash Daily Review: Soda Ash Market is Weak, Local Markets Adjusted Slightly1049

- 4.14 Glass Daily Review: Float glass market maintains consolidation999

- Soda Ash Weekly: The imbalance between market supply and demand has intensified, and prices continue to fall (20250411 issue)1080